Currency Devalution: Pros and Cons

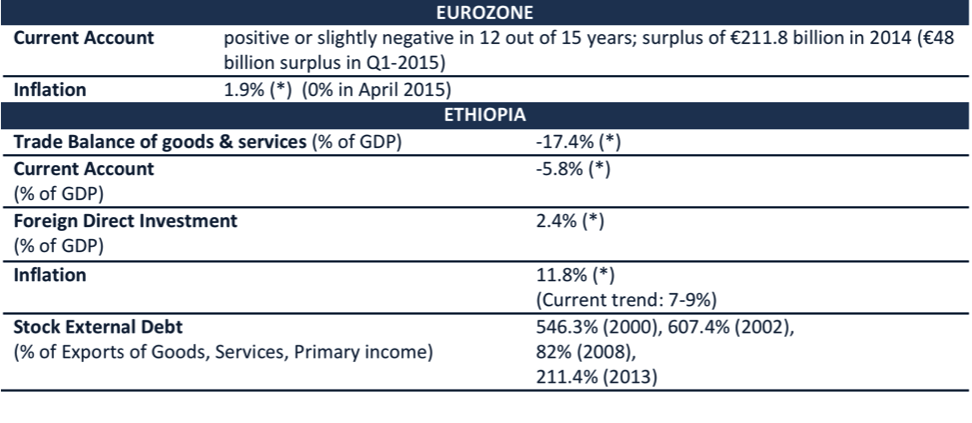

The euro was worth 6.94 birr in October 2000, and then peaked in April 2014 at 27 birr before falling to 21.93 in March 2015.During the fifteen-year period economic fundamentals were as follows:

Early 2000, Ethiopia’s external debt was unsustainable. Debt forgiveness/rescheduling in 2000-2008 and 2010 – plus substantial external aid – have brought indebtedness to a manageable level. In 2014, the debt to GDP ratio was a healthy 22.6% (est.), but is now increasing due to public sector investment expenditure. External debt as a percentage of exports and primary income looks less healthy as export performance remains unsatisfactory.

If the inflation differential between Ethiopia and Euro zone turns out 8.5% in 2015, then the exchange rate recorded in Q1-2015 means a 25% real exchange rate appreciation of the BIRR against the Euro compared to 2014. Unrealistic, considering Ethiopia’s CA deficit – even when corrected for FDI inflows – while the Euro zone CA may top €200 billion surplus in 2015. Finally, the forex reserves exceeded 3-month worth of imports in 2002-03; reserves are currently about 2 months only. Foreign currency shortage is a recurrent problem in Ethiopia explaining the existence of a parallel market and rationing of foreign exchange. Of course, the issue of devaluation is sensitive because devaluation produces winners and losers. But, what devaluation seeks to achieve is a change in the relative price of exportable goods (vis-à-vis non-tradables) resulting hopefully in a boost of export performance, and, a disincentive to imports (thus a strategy of efficient import substitution).

EXCHANGE RATE REGIMES

The choice of an exchange rate regime is important for competitiveness, macroeconomic stability and growth. Exchange Rate regimes are classified as fixed exchange rate, fully floating market-determined exchange rate or intermediate regimes. Ethiopian authorities describe their Exchange Rate regime as a managed float (= intermediate regime) with no predetermined path for the exchange rate.

Before an auction system was established in 1992/93, the BIRR was pegged to the USD at 2.07 BIRR. An inter-bank foreign exchange

market was created in October 2001 with the National Bank of Ethiopia intervening.

Historically, depreciation pressures on the BIRR have prevailed. While the USD-BIRR rate stands around 20.5 in May 2015, the IMF (Oct. 2014) estimated the Real Effective Exchange Rate overvaluation in the range of 10-13%. The “authorities acknowledge that a competitive exchange rate is important but consider too rapid adjustment to be counterproductive due to feedback effects on inflation”.

Under Ethiopia’s regime:

- Ethiopians and Residents of Ethiopia surrender, through a forex bureau, all foreign currencies in their possession against payment in BIRR.

- Exporters are allowed to maintain a retention account to hold a specified amount of their export earnings for a defined period, with the remainder being surrendered by local banks to NBE. The percentage of authorized retention has fluctuated over time (and is determined by Directive; the rate was 10% (Directive 11/1998).

- The NBE determines terms and conditions for transfer of foreign exchange and the exports or imports of goods (import permits).

MONETARY POLICY

The NBE aims to maintain sufficient international reserves to cover (a) payments for immediate and short term imports of commodities and services into Ethiopia, (b) foreign debt payment commitments. When reserves decline, the Governor considers remedial measures and may suspend issuance of foreign exchange permits.

The bank carries out monetary management with a mix of policy instruments: sale/ purchase of securities issued by Government, a central bank credit facility to cover commercial banks’ short-term need, reserve requirements, setting floor deposit interest rate, use of credit control and moral suasion.

The Monetary Policy Committee of the NBE reviews quarterly the economic developments and proposes a monetary policy stance to the

Board of Directors in line with targets for inflation, growth rates of monetary aggregates, GDP growth rate, the real equilibrium exchange rate and the foreign exchange reserve.

The NBE is the biggest generator of foreign currency and enables it to intervene as the major market player, assuring exchange rate stability to some degree.

The dilemma of any policy decision maker is to achieve x targets with y instruments. If the number of targets exceeds the number of instruments available, then meeting the targets would be a matter of pure coincidence. Even if the number of Central Bank’s policy instruments exceeds the number of targets, it is not certain that the CB will be able to meet trend targets as it has limited or no influence on productivity growth, investments and external demand. Therefore, it may miss one or several targets. The question is which ones shall be sacrificed?

IMPACT OF DEVALUATION

Economists focusing on economic fundamentals as drivers of exchange rate movements look at:

- Price inflation differentials;

- Current Account: surpluses (deficits) cause currency appreciation (depreciation). The long-run equilibrium exchange rate comes with a sustained balanced Current Account.

- Differentials in domestic/foreign money demand and nominal interest rate, between countries;

- Stock of foreign debt relative to GNP (or to Exports). A high ratio is considered a risk. Potential investors require a risk premium above the normal nominal interest rates in order to make up for the expected future depreciation necessary to rebalance the Current Account deficit.

Pressure for devaluation comes from a deterioration of domestic competitiveness due to domestic inflation being higher than inflation in competitor countries, from the existence of unsustainable Current Account deficits and increase in foreign debt (affecting the creditworthiness), or other reasons (e.g. the structure of foreign debt).

Speculative attacks do occur resulting in ER movements not in line with fundamentals.

From the observation of two experiences with devaluation (Franc CFA in 1994 and 1997 Asian financial crises) we have learnt that:

- After devaluation, the Balance of Trade significantly improved in 8 countries out of 14. It worked for the Asian economies.

- Export volumes improved, after devaluation, in 7 out of 9 CFA countries. By contrast, export performance deteriorated in all Asian economies, although the performance was still solid.

- Growth in Import volumes actually increased in the 10 years following devaluation in 7 out of 9 CFA countries 9 studied. In all Asian countries imports growth fell, as a result of lower domestic demand, explaining why currency devaluation in the Asian economies improved the Balance of Trade.

- GDP growth visibly improved in all but one of the CFA countries, constituting a turnaround from negative growth experienced before devaluation. By contrast, GDP growth in Indonesia, Korea, Thailand and Malaysia fell significantly from previous solid growth, though resuming in year-2.

- The Investment rate (as % of GDP) improved in all but one of CFA countries studied. Thus, devaluation is compatible with resource mobilization and GDP growth. By contrast, the investment rate fell in all five Asian economies studied, coming down from very high – unsustainable – rates in Korea, Thailand and Malaysia.

Post-devaluation inflation is often used as an argument AGAINST. In Indonesia and Thailand, devaluation triggered double-digit inflation for 2 years. However, fears for sustained inflation were exaggerated; the dynamics of the price spiral is not known beforehand but depends on country-specific circumstances. It is also

true that domestic price increase erodes the initial positive impact on price competitiveness, but this is a process takes up to ten years in most cases.

The difficulty of CFA economies to maintain high economic growth under conditions of sustainability, following currency devaluation, is linked to a structural issue. For an economy to be able to increase export supply and to substitute for imports, its industry must be sufficiently diversified. One expects the supply response to be stronger the larger the manufacturing base of the economy. This was the case in Asia. Ethiopia’s economy is notoriously undiversified.

In conclusion, currency realignment can work. If the objective behind a devaluation strategy is to restore price competitiveness, then the devaluation basically BUYS YOU TIME to develop intrinsic competitiveness in your tradables sectors. Competitiveness requires business upgrading to boost productivity, product/services innovation and market diversification. These are processes which cannot be changed overnight.

The Economist - Ethiopia Summit

EU consultation meeting: Strenghthening the role of private sector

Awex - Belgium Delegation in Addis Ababa

Joint EU investment mission to Ethiopia

Weight limit on containers imposed by the Maritime Affairs Authority - A happy End

Welcoming the Finnish Prime Minister's Delegation

Ambassador Hebberecht - New head of the EU Delegation

EUBFE held its 1st Anniversary

As you all know, the EUBFE held its 1-Year Anniversary ceremony last week (29th May) at the Radisson Blu, Addis Ababa. The event welcomed more than 150 participants and included a presentation by high level government officials (H.E. State Minister, Ministry of Industry, Tadesse Hailewho highlighted the need to scale up EU investment to Ethiopia, Ato Kaidaki Acting Director General of ERCA who emphasised the fruitful dialogue that took place between the EUBFE and ERCA, as well as H.E. Ambassador Grum from the Ministry of Foreign Affairs who paid a personal tribute to Xavier Marchal).

Indeed, this event was also the opportunity to honor the memory of H.E. Xavier Marchal, Head of EU Delegation to Ethiopia, who passed away just a few days before the Conference. As many of you know, Xavier followed the activities of the EUBFE over the last year with great personal interest and involvement, and undoubtedly was one of the main motors of the Forum. The event was thus also used as an opportunity to pay tribute to the personal efforts of Xavier Marchal to make the EUBFE a reality.

We also reviewed the activities performed by the EUBFE within the past year and expectations for the year to come, as well as offered a networking opportunity for the EU business community. At the meeting it was highlighted that over the last twelve months, the EUBFE has developed itself, despite relatively limited means, into a well-respected platform both among government circles and the business communities that is increasingly able to strongly advocate for the removal of the sharpest edges of the government’s laws and regulations. The EUBFE is also seen as an increasingly important and valued facility to help existing and potential EU investors do business in Ethiopia.

Over the past 12 months around 15 meetings and presentations were organized, most of them in collaboration with the EU Delegation. Taxes and customs being key issues affecting the current business climate, ERCA was the center of the attention with 4 meetings on (amongst others) the new customs proclamation and on dividends tax. The EUBFE prepared a detailed comment paper on the new customs law. Some of the issues raised in the paper have found their way in the final version of the proclamation. In order to advocate its members’ rights, EUBFE also worked with the Ministry of Transport on addressing the concerns of the sudden implementation of the multimodal transport directive which mid last year seriously disrupted import and export from Djibouti Port. The EUBFE managed to advocate for a series of exceptions and ensured a focal point in the Ministry of Transport for members who encountered specific problems. The Prime Minister expressed its appreciation for the EU Business Forum and its ability to make around 300 EU companies speak with one voice during his meeting with President of the European Commission Barosso as well as on the occasion of the October 2012 meeting with foreign investors on the business climate. He has also been solicited by the EUBFE at the height of the foreign currency shortage beginning of this year. On the latter issue the EUBFE, together with the EU Delegation, held also talks with the Governor of the National Bank of Ethiopia, the President of the Commercial Bank of Ethiopia and the Minister of Industry. The EUBFE further provided its inputs to the Ministry of Industry in its endeavour to carve out an industrial road map for the country. The Ministry of Industry– together with the Ethiopian Investment Agency – also organised several consultation meetings on the new investment proclamation and the new investment regulations (in force since end 2012) for EUBFE members. Concurrently, the development of a website and a newsletter allowed a better visibility of the EU community issues and EUBFE’s actions. The association is also currently working on further financing (BizClim facility) to bring experts on board to substantiate its work and improve local business climate.

Further events and activities will be organized in the coming months, with a focus on continuing the structured dialogue with the Government of Ethiopia (including MoT, ERCA, EIA, MoI,…). Towards the second half July we have agreed with ERCA to organise a consultation in the EU Delegation – jointly with the major other foreign business fora – on the draft tax proclamation, while we are also currently working with the Ethiopian Investment Agency on a consultation on the investment proclamation that is (again) being redrafted. We will keep you informed on these and otherupcoming events. As we did in the past, we shall also react to relevantburning business climate issues as they come along and we encourage you in this regard to continue sharing with us what are the obstacles in the development of your business in Ethiopia.

You can find the Secretary’s detailed presentation on the first year’s activities of the EUBFE in the download part of our website (http://www.eubfe.eu/index.php/downloads). You’ll find some of the excellent press coverage of the event (both on television and in the newspapers) also on the website.

Also to note that during the cocktail, some of our members had the opportunity to showcase their services and products to the visitors. We would like to thank them again for their support in the organization of the event and taking the time to set up the booths. We intend to repeat a similar exhibition next year and hope that even more of you will be able to demonstrate the richness and diversity of EU investment in Ethiopia.

The Secretary

EU Export Help Desk Training – 25th – 27th February 2013

The EU export help desk (www.exporthelp.europa.eu) is an on-line service of the European Commission providing support to companies from developing countries on how to export to the EU. A mission from the EU Export Helpdesk to Ethiopia is planned from 25-27 February. The mission will include a full day of product specific trainings (leather, organic coffee, oil and sesame seeds) on February 26th. Should you be interested in attending such a training, or if you would like to have more information, kindly contact the EUBFE’s secretariat